Valuation Multiples for a Physical Therapy Practice

The U.S. physical therapy industry consists of more than 132,000 practicing physical therapists. This industry comprises professionals administering medically prescribed rehab through outpatient services for patients suffering from pain and injuries. Overall, this industry has a combined annual revenue of between $48 billion. The following is a quick summary of what multiples for a physical therapy practice look like.

Be sure to also check out our post on Valuing a Physical Therapy Practice. To better understand how to value a physical therapy practice, schedule your free consultation with Peak Business Valuation, business appraiser Utah.

**Disclaimer: These multiples are provided for educational purposes only. As such, the information provided does not constitute valuation advice and should not be acted as such. These multiples do not represent the valuation opinion of Peak Business Valuation or any of its valuation professionals. Instead, you should seek the guidance and advice of a qualified business valuation professional with respect to any matter contained in this article.

Revenue Multiples for a Physical Therapy Practice

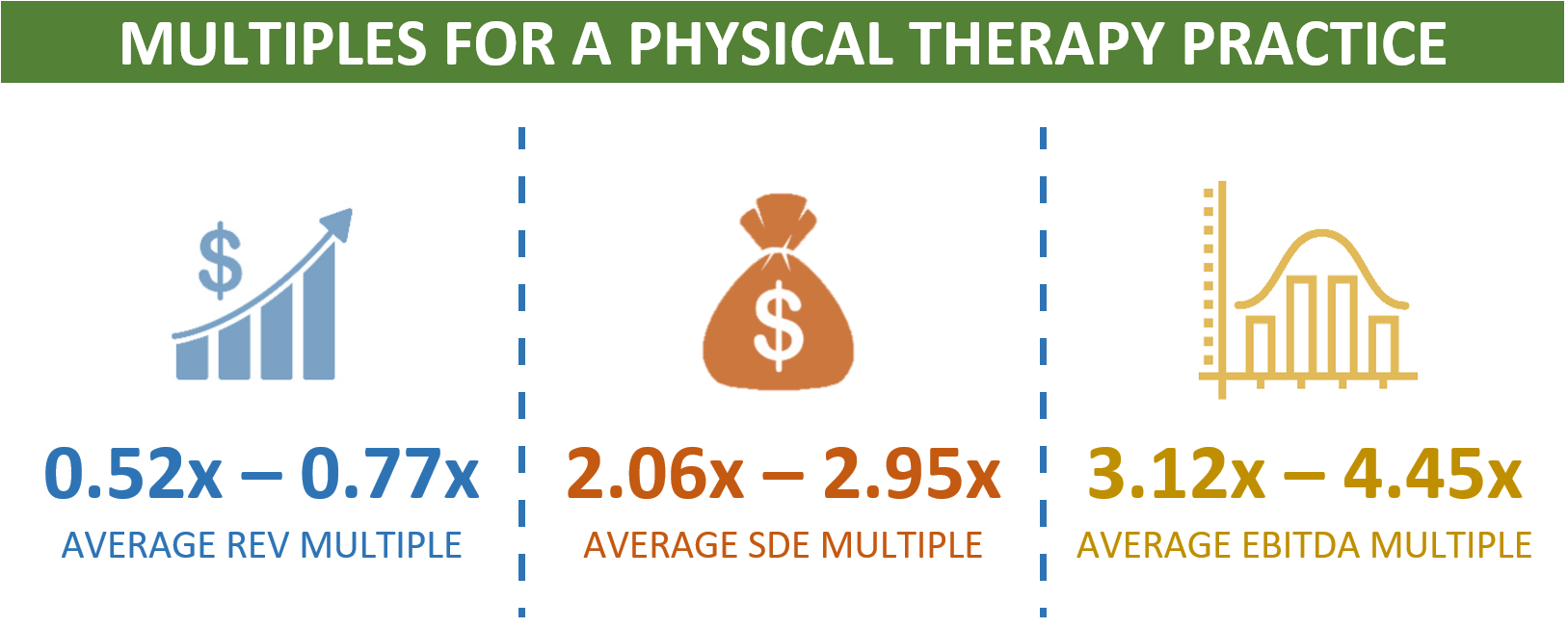

According to our data, physical therapy practices sold for an average range of 0.52x – 0.77x of revenue. The term multiple is a valuation metric that refers to the implied value of a business. It is calculated by multiplying the amount of revenue or sales a business makes by the valuation multiple.

Revenue X Multiple = Value of the Business

For instance, if a physical therapy practice generates $950,000 in revenue and transacts at a 0.54x multiple, then the business value is worth approximately $513,000.

$950,000 X 0.54x = $513,000

A revenue multiple is not typically used for valuing a physical therapy practice(s). Physical therapy practices vary depending on collections. As such, collections are particularly important i.e. how clients pay via insurance, Medicare, cash, etc. Other factors that may impact a revenue multiple include government regulation, skill of the workforce, market, and pricing. For more information on value drivers, schedule your free consultation today! And read Value Drivers for a Physical Therapy Practice, Valuing a Physical Therapy Practice, and How to Value a Physical Therapy Clinic.

Seller’s Discretionary Earnings (SDE) Multiples for a Physical Therapist

The average SDE multiples for physical therapy practice fall between 2.06x – 2.95x. Apply this multiple to SDE to derive an implied value of the physical therapy practice. The calculation is as follows:

SDE X Multiple = Value of the Business

For example, if a physical therapy practice has a seller’s discretionary earnings of $700,000 and is estimated to sell at a 2.54x multiple, then the physical therapy practice’s value is approximately $1,778,000.

$700,000 X 2.54x = $1,778,000

Seller’s discretionary is a common cash flow multiple to use for small business transactions. SDE is computed by starting with your company’s EBITDA and adding back potential expenses that would not otherwise be incurred by a new owner. These expenses may include the owner’s compensation and the manager’s salary. Additionally, other expenses such as auto, and nonrecurring items, or events such as legal fees, and consulting. For more information see Seller’s Discretionary Earnings.

This approach is most frequently used as a valuation method for small businesses with sales of less than $3M.

EBITDA Multiples for a Physical Therapy Practice

The average EBITDA multiples for physical therapy practices over the last five years range between 3.12x – 4.45x. The following is the EBITDA multiple calculation.

EBITDA X Multiple = Value of the Business

*EBITDA = Earnings Before Tax + Interest + Depreciation + Amortization

For example, a physical therapy practice has an EBITDA of $1,500,000 and an EBITDA multiple of 3.4x. Using the above metrics, the approximate value of a physical therapy practice is $5,100,000.

$500,000 X 3.4 = $5,100,000

The EBITDA multiple is a valuation ratio that measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation, and fixed assets. Normalized ratios allow for comparisons to similar businesses. Normalization is the process of removing non-recurring expenses or revenue from a financial metric like EBITDA, EBIT, or earnings. Once earnings have been normalized, the resulting number represents the future earnings capacity that a buyer would expect from the business.

Summary

When looking at multiples for a physical therapy pracitce, keep in mind there are many unique factors that impact a business. The valuation expert will determine what methods and multiples to use when valuing a physical therapy practice. We would love to talk with you more about the factors that may impact the value of a physical therapy practice.

Peak Business Valuation, business appraiser, enjoys working with small business owners to help maximize the value of a physical therapy practice. We focus on providing valuable information to help you grow, sell, or buy a physical therapy practice. We have provided business valuations of physical therapy practices across the country. Questions are always welcome. Please reach out by scheduling your free consultation today!