Valuing a Lumber Wholesale Company

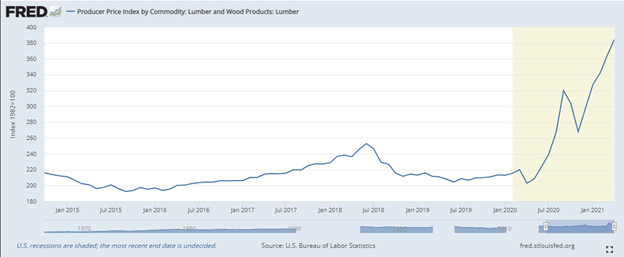

In May 2021, talk about the economy inevitably circles back to rising lumber prices. From grandpa grumbling about how he will never finish his cabinets at these prices to general contractors scratching their heads about how they will complete projects on budget. But how much has the price of lumber increased? The figure below from the FRED database shows the price of lumber to producers since January 2016. To say we are out of trend is an understatement.

The economy is experiencing an unprecedented demand for lumber, driving up lumber prices. According to IBISWorld, construction makes up 24.4% of industry revenue, the bulk of which is residential construction. According to the FRED database, the median days on market for the housing industry is at a historic low of 43.0 days, compared to a low of 56.0 days in July 2019. Additionally, new building permits issued are the highest they have been since July 2003. These economic factors contribute to increased lumber prices.

Valuing a Lumber Wholesale Company

The price of lumber, other macroeconomic factors, as well as company-specific factors all tie into the value of a lumber wholesale company. It may be tempting to look at a “rule of thumb” multiple when valuing a lumber wholesale company to arrive at a value. While this may provide a good estimate, it does not take into consideration all the factors mentioned above. Some may be looking to buy or sell a lumber wholesale company. In this case, it is important to understand the fair market value of a lumber wholesale company.

In this article, we will first discuss common multiples for a lumber wholesale company. Then the effect of the price of lumber on a company’s value, and other key factors to success in the industry. Our goal is to help you understand how a certified appraiser thinks about valuing a lumber wholesale company. Get started by scheduling your free consultation!

Common Market Multiples for a Lumber Wholesale Company

Professionals look at market multiples to gauge the price of a lumber wholesale company. For a wholesale company, EBITDA and SDE multiples are the most important multiples. The following multiples come from the PeerComps database. The companies selected had less than $20 million in revenue.

REV Multiple – Revenue multiple:

- Average: 0.34x

- Range: 0.21x – 0.36x

SDE Multiple – Seller’s Discretionary Earnings multiple:

- Average: 2.90x

- Range: 2.55x – 3.23x

EBITDA Multiple – Earnings Before Interest, Tax, Depreciation, and Amortization multiple:

- Average: 3.55x

- Range: 3.13x – 3.99x

** Disclaimer: These multiples are for educational purposes only. Multiples are based on companies with revenues between $1-$10 million. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

How Lumber Prices Affect the Value of a Lumber Wholesale Company

Some companies’ business activities are closely related to a commodity such as steel, coal, oil, or lumber. In these cases, the price of the commodity affects the company’s financial performance. High prices at sawmills have increased revenue and profits for lumber wholesale companies. This bumper year is unlikely to persist in the long term. At Peak Business Valuation, business appraiser, we often look at historical price averages to better understand a company’s operations for a normal year. This is generally a better indicator of value.

Key Success Factors in the Lumber Wholesale Industry

In addition to macroeconomic factors, market multiples, and lumber prices company-specific success factors impact the value of a lumber wholesale company. These factors are why there is a wide range of multiples that lumber wholesalers transact at. Peak Business Valuation, business appraiser, calls these quantitative and qualitative factors “key success factors.” We will explore a few common factors for the lumber wholesale industry below. These include supplier concentration, stock on hand methods, and proximity to key markets. Each key success factor impacts the value of a lumber wholesale company. Don’t forget to schedule your free consultation today!

Supplier Concentration

The reliability of a company’s suppliers is a key indicator of success. Measuring reliability is not an exact science, but there are a few indicators of healthy supplier relationships. At Peak Business Valuation, business appraiser, we review a company’s supplier list. Generally, if one supplier is supplying over 10% of the company’s inventory we examine it further. If the top three suppliers are providing a major portion of inventory there could be an increased risk.

Another indicator of healthy supplier relationships is favorable contracts. Contracts with suppliers can help hedge against risk and ensure the company receives reliable inputs. At the same time, contracts can lock companies into unfavorable conditions. This can affect profit margins. Having established relationships with suppliers can help a company in a pinch when another supplier fails. All these factors impact the risk of the company, and thus the company’s fair market value. Having diversified suppliers can increase the value of a lumber wholesale company.

Stock on Hand

The ability of a company to meet its customer demand at all times is imperative to its success. A question we ask lumber wholesalers is, “what methods are used to prevent stockouts?” Frequent stockouts can put a bad taste in customers’ mouths, driving away business. A solid reputation of reliable service is hard to earn, and it could warrant a premium to a business’s value. Conservative safety stock levels paired with a diverse pool of suppliers are a good combination to help prevent stockouts.

Proximity to Key Markets

A company’s proximity to key markets can be a significant competitive advantage. Homebuilders seek to lower their delivery costs by ordering from lumber wholesale companies nearby. Additionally, this can help save time for construction companies on a tight deadline. Lumber is a commoditized good. One quality of commoditized goods is that they are not unique products. In other words, one lumber wholesale doesn’t provide better lumber than another. Lumber wholesalers do not compete based on the uniqueness of their products. Because of this, price and proximity are two key competitive factors. As such, the price and proximity impact the value of a lumber wholesale company.

Summary

This covers a few considerations a certified appraiser takes when valuing a lumber wholesale company. This industry is unique and no two businesses are alike. Generic rules of thumb do not cover all the factors a certified appraiser considers. Additionally, experience in the industry can alert an appraiser to red flags and highlight strong points in a company’s operations. To better understand the value of a lumber whole company, reach out to Peak Business Valuation, business appraiser. Schedule your free consultation by clicking the link below. We are happy to answer any questions you may have about valuing a lumber wholesale company!

For further ideas be sure to take a look at Value Drivers for a Lumber Wholesaler, How to Value a Lumber Wholesale Business, and Valuation Multiples for Lumber Wholesalers.