Specialty Contracting Valuation Multiples

When preparing to buy, expand, or sell a specialty contracting business, gaining a clear understanding of the company’s value is vital. A common valuation method used in early-stage planning is applying valuation multiples. These figures offer a broad fair market value estimate based on similar specialty contracting companies that recently sold. When applied correctly, specialty contracting valuation multiples provide helpful insight into your company’s performance and market position.

In this article, we discuss common specialty contracting valuation multiples and key factors to consider when using them. Please note that the figures we discuss below are general market averages and may not reflect the exact value of a particular business. For a reliable specialty contracting business valuation, connect with a qualified and experienced business appraiser.

As a professional business appraiser, Peak Business Valuation regularly supports individuals who are looking to buy, grow, sell, or secure funding for a specialty contracting business. We are here to provide a professional business valuation and answer any questions you may have about valuing a specialty contracting business. Start today by scheduling a free consultation below!

What Are Specialty Contracting Valuation Multiples?

Valuation multiples, or market multiples, are ratios used to estimate a company’s fair market value. For a specialty contracting business, valuation experts calculate these figures by reviewing recent sales of comparable companies. After identifying appropriate multiples, valuation experts apply them to key financial indicators, such as earnings or revenue, to calculate fair market value. Specialty contracting valuation multiples provide a general sense of where the business stands in today’s marketplace. For more insight, see Valuation Multiples for Specialty Contracting Businesses.

Common Specialty Contracting Valuation Multiples

During a specialty contracting business valuation, Peak Business Valuation often uses multiples derived from Seller’s Discretionary Earnings (SDE), EBITDA, and revenue. Each multiple provides a different perspective on the business’s financial performance and risk profile. To provide a balanced valuation, business appraisers often use a variety of multiples.

SDE Multiples for a Specialty Contracting Business

Seller’s Discretionary Earnings (SDE) reflect the total financial return available to a single owner-operator of a contracting business. It is calculated by adding items like owner compensation, personal benefits, and discretionary expenses back to net income. SDE multiples are often used for smaller or owner-operated specialty contracting businesses.

Formula: Value = SDE × Multiple

Range: SDE multiples for specialty contracting businesses commonly range between 2.39x and 3.49x SDE.

EBITDA Multiples for a Specialty Contracting Business

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s operational profitability without considering non-operating factors. As such, EBITDA multiples assess value based on a business’s operational efficiency and earnings potential. Business appraisers often refer to this metric when comparing larger contracting companies with complex structures.

Formula: Value = EBITDA × Multiple

Range: EBITDA multiples for specialty contracting businesses often fall between 3.39x and 4.07x EBITDA.

Revenue Multiples for a Specialty Contracting Business

Revenue multiples compare the business’s value to the total amount of revenue generated over the most recent 12-month period. This method is often less reliable since it does not take profitability into account. However, it can provide useful context when analyzed alongside earnings-based multiples like SDE or EBITDA.

Formula: Value = Revenue × Multiple

Range: Specialty contracting businesses often trade between 0.35x and 0.88x revenue.

When valuing a specialty contracting business, Peak Business Valuation assesses valuation multiples. In addition, our valuation experts take careful measures to account for unique internal and external factors that affect value. This ensures a well-supported and defensible valuation that supports effective business decisions. To learn more about how to value a specialty contracting business, schedule your free consultation with Peak Business Valuation below.

How to Value a Specialty Contracting Business Using Multiples

Applying valuation multiples is a relatively simple concept. However, producing credible results requires professional expertise. During a professional specialty contracting business valuation, an analyst reviews unique factors such as financial stability, customer concentration, project backlog, and operational risk. These variables help determine which multiples are most applicable. Weighted averages are also used to smooth out fluctuations in income. This comprehensive process provides a precise and reliable fair market value. For more insight, see How to Value a Specialty Contracting Business.

Rules of Thumb for Specialty Contracting Businesses

Valuation multiples are commonly used as general rules of thumb when estimating the fair market value of a specialty contracting business. While these methods are useful for initial planning, they do not account for the unique characteristics of a specific company. As such, results may not be accurate and should not be used to make major financial decisions. If you need a credible valuation to buy, grow, sell, or secure financing for a contracting business, it is important to consult a certified valuation expert. If you have questions, reach out to Peak Business Valuation today!

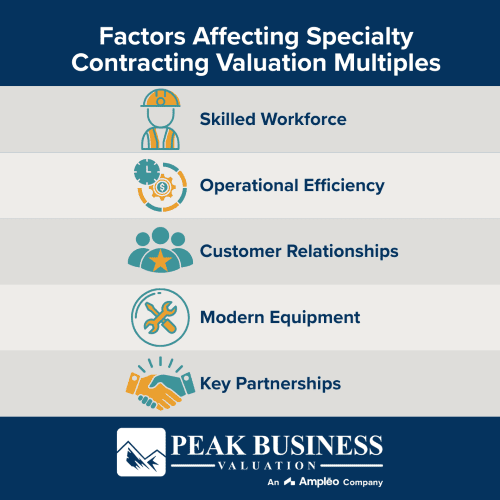

Factors Affecting Specialty Contracting Valuation Multiples

Many elements can influence whether a specialty contracting business receives higher or lower valuation multiples. Understanding these value drivers can help business owners identify areas for improvement and increase their company’s value. Below are several key factors that impact specialty contracting valuation multiples:

- Skilled Workforce: Employing a well-trained and experienced workforce promotes high-quality work and minimizes mistakes. Businesses that invest in skill development reduce risk and often command higher valuation multiples.

- Operational Efficiency: Implementing efficient processes allows contracting businesses to complete projects on time and control labor costs. High operational efficiency leads to increased profitability, a stronger market position, and favorable valuation multiples.

- Customer Relationships: Consistently handling clients with professionalism and open communication strengthens trust and satisfaction. Strong customer relationships often translate to repeat business and referrals, which promote financial stability and stronger valuation multiples.

- Modern Equipment: Investing in newer, more efficient equipment improves productivity, minimizes project delays, and lowers operating costs. These advantages foster profitability and can justify stronger specialty contracting valuation multiples.

- Key Partnerships: Building relationships with subcontractors and trade specialists ensures consistent, high-quality outcomes. With a strong network, you can reduce operational disruptions and increase buyer confidence in the business.

To learn more about increasing the value of a specialty contracting company, read Value Drivers for Specialty Contracting Businesses.

Conclusion

Valuation multiples are a common starting point for estimating a specialty contracting business’s fair market value. These ratios provide broad estimates based on comparable specialty contracting businesses that were recently sold. However, market multiples alone often provide inaccurate results because they do not account for unique value drivers. Consequently, multiples should not guide important business decisions. For a defensible specialty contracting business valuation, it is best to work with an experienced valuation professional.

At Peak Business Valuation, we provide business valuations for buying, selling, expanding, or securing financing for specialty contracting businesses. We are happy to support you and answer any questions you have about how to value a specialty contracting business. Schedule your free consultation with Peak Business Valuation today!

For additional resources, see Valuing a Specialty Contracting Business and Specialty Contracting Business Valuations.