Valuation Multiples for a Dental Practice

The U.S. dental industry has more than 180,000 practicing dentists. This comprises medical professionals engaged in practicing general or specialized dentistry services or dental surgery. This industry has a combined annual revenue of about $183 billion. Here is a quick summary of what multiples for a dental practice look like. Be sure to also check out Valuing a Dental Practice, Value Drivers for a Dental Practice, and How to Value a Dental Practice.

According to our data, in 2019 dental practices sold for an average 0.65x revenue multiple. The term multiple is a valuation metric that refers to the implied value of a business. It is calculated by multiplying the amount of revenue or sales a business makes by the valuation multiple.

Revenue X Multiple = Value of the Business

For instance, if a dental office generates $700,000 in revenue and transacts at a 0.65x multiple, then the business value is worth approximately $455,000.

$700,000 X 0.65x = $455,000

Dental practices have much the same cost structures. As such, collections are very important. Therefore, the revenue multiple is heavily relied upon. In addition, other factors that may be considered include the number of new patients, recurring work, revenue growth, and the client base (private insurance, government-funded, cash). See the below graphics for how revenue multiples have trended over the last few years and how they trended by company size in the dental industry.

Seller’s Discretionary Earnings (SDE) Multiple

In 2019, the SDE multiple was 1.70x for dental practices. This multiple is applied to SDE to derive an implied value of the business. The calculation is as follows:

SDE X Multiple = Value of the Business

For example, if a dental practice has seller’s discretionary earnings of $850,000 and is estimated to sell at a 1.70x multiple, then the business is worth approximately $1,445,000.

$850,000 X 1.70x = $1,445,000

Seller’s discretionary is a common cash flow multiple used in small business transactions. SDE is derived by starting with your company’s EBITDA and adding back potential expenses that would not otherwise be incurred by a new owner. These expenses may include owner’s compensation, manager’s salary, other expenses such as auto, and nonrecurring items, or events such as legal fees, and consulting.

This approach is most frequently used as a valuation method for small businesses with sales of less than $3M. See the below graphics for how SDE multiples have trended over the last few years and how they trended by company size in the dental industry.

EBITDA Multiple

The average EBITDA multiple for dental practices in 2019 was 1.63x. The following is the EBITDA multiple calculation.

EBITDA X Multiple = Value of the Business

*EBITDA = Earnings Before Tax + Interest + Depreciation + Amortization

For example, a dental practice has an EBITDA of $500,000 and an EBITDA multiple of 1.63x. Using the above metrics, the company is worth approximately $815,000.

$500,000 X 1.63 = $815,000

The EBITDA multiple is a valuation ratio that measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation, and fixed assets. Normalized ratios allow for comparisons to similar businesses. Normalization is the process of removing non-recurring expenses or revenue from a financial metric like EBITDA, EBIT or earnings. After normalizing earnings, the resulting number represents the future earnings capacity that a buyer would expect from the business.

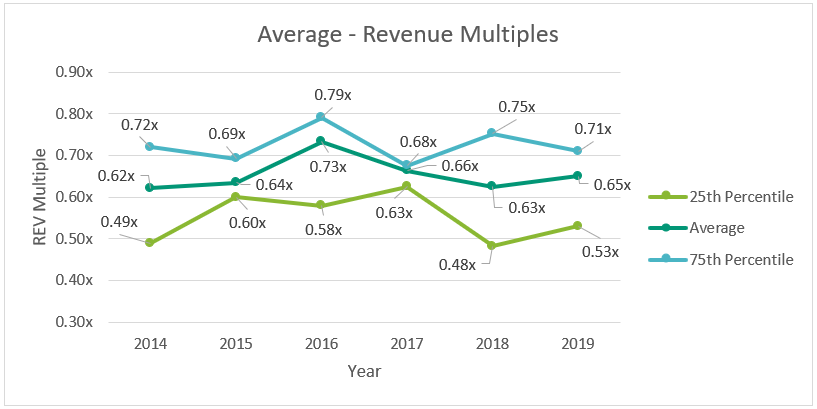

The Trend of Average Revenue Multiples

The following graphic shows how revenue multiples have trended over the last few years in the dental services industry.

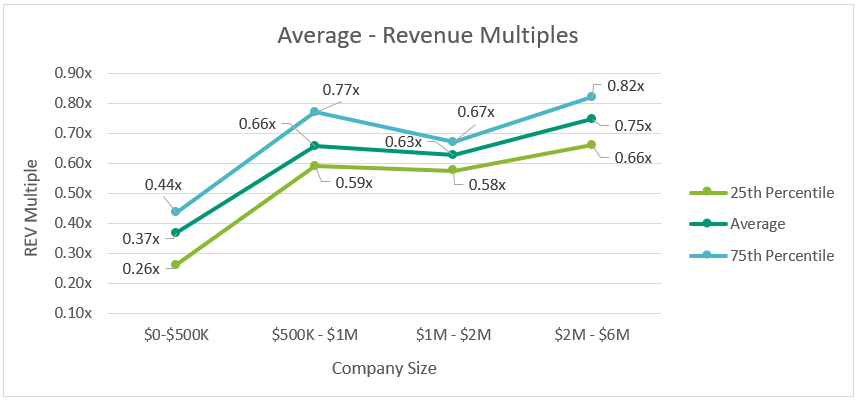

Impact of Size on the Revenue Valuation Multiple

The following graphic shows how business size impacted revenue multiples for dental practices over the last few years.

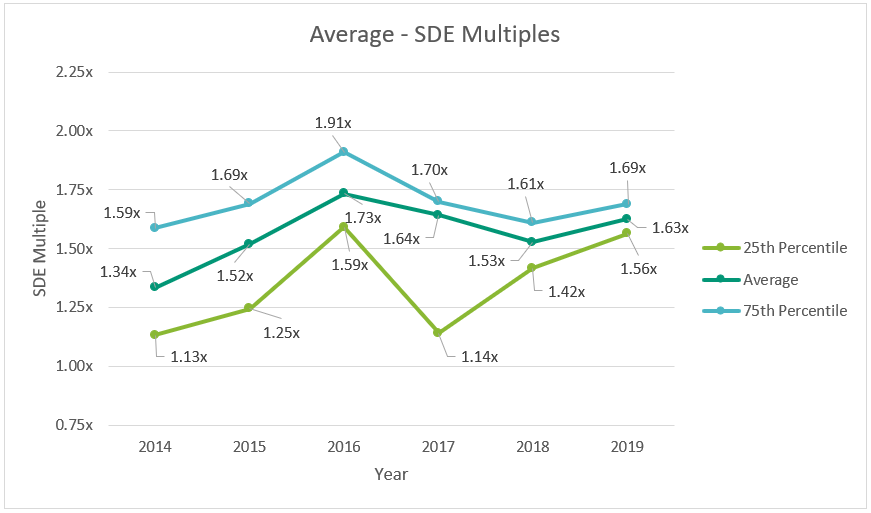

The Trend of Average SDE Multiples

The following graphic shows how SDE multiples have trended over the last few years in the dental services industry.

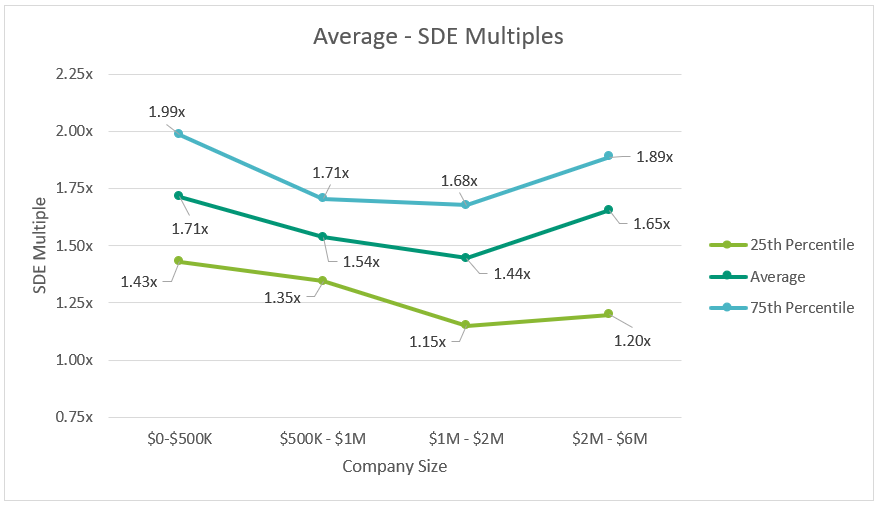

Impact of Size on the SDE Valuation Multiple

The following graphic shows how business size impacted SDE multiples for dental practices over the last few years.

When looking at multiples for a dental practice, keep in mind there are many unique factors that impact a business and the multiple used to value that business. We would love to talk with you more about the factors that may impact the value of your dental practice.

Peak Business Valuation enjoys working with small business owners to help maximize the value of their dental practice. We focus on providing valuable information to help you grow, buy, or sell a dental practice. We have worked with several dental practice owners to provide a business valuation. Questions are always welcome! Please reach out by scheduling a free consultation.

Schedule Your Free Consultation Today!