Valuation Multiples for a Hardware Store

Hardware stores in general fared the pandemic well. With stay-at-home orders, many individuals were doing more DIY projects. This caused the hardware store industry to increase by nearly 3.4% in 2020. It is projected to continue expanding but at a slower rate in the coming years. The hardware store industry includes businesses that retail a broad range of home renovation, equipment, and supplies. Goods commonly include hardware, electrical, plumbing, and paint-related supplies. There are nearly 15,000 hardware stores across the United States. These stores generate over $235 billion in revenue. This industry is highly fragmented with the largest player being Ace Hardware Store with 2% of the market. As such, there are many transactions of hardware stores each year. If you plan on buying or selling a hardware store, knowing the value of a hardware store is key. When valuing a hardware store, a valuation expert often utilizes valuation multiples for a hardware store.

Valuing a Hardware Store

A valuation expert values a hardware store using several valuation methods. This can include using multiples for a hardware store. When determining the fair market value of a hardware store, a valuation expert often looks at the financials and key value drivers. Some of the key value drivers for a hardware store include revenue streams, team, and stock on hand, among others. The valuation expert will assess your business and compare it to similar hardware stores across the country that recently sold. For more information see Valuing a Hardware Store as well as Value Drivers for a Hardware Store.

A business valuation determines the value of a hardware store. If you plan on selling a hardware store, a business appraisal is important in deciding a fair listing price. You don’t want to list your hardware store for more than it is worth, but you also don’t want to leave money on the table. A business appraisal is also useful to help maximize the value prior to selling your business.

If you are looking to buy a hardware store, a business appraisal will help you understand the fair market value. The business valuation report becomes a useful tool for negotiating the purchase price. This is because it helps you understand the strengths and weaknesses of the business. It can also help you feel confident in your business purchase.

As a business appraiser, Peak Business Valuation values hardware stores regularly. Below is an overview of average valuation multiples for a hardware store. Keep in mind these numbers are only a guide. For specific information about a hardware store, you are buying or selling, please reach out. We are happy to answer any questions you have about valuing a hardware store. Schedule a free consultation today to get started!

Valuation Multiples for Hardware Stores

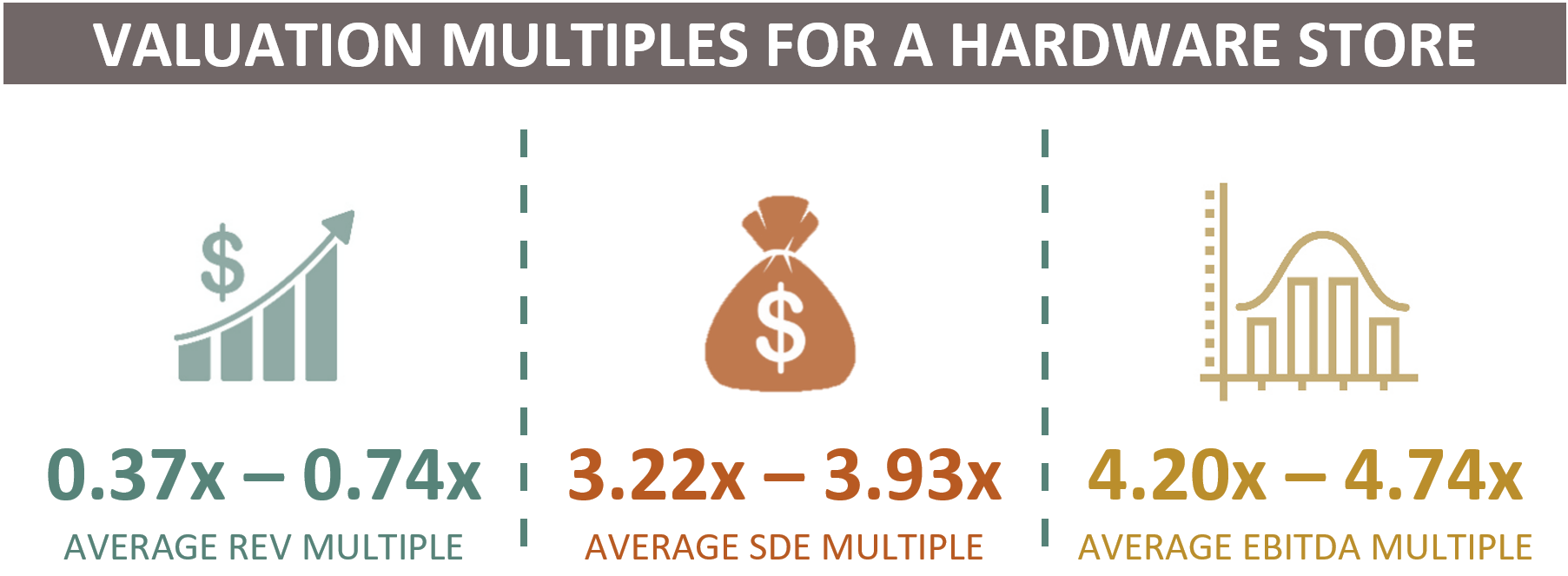

In the following visual, we show average valuation multiples for a hardware store. These market multiples are what hardware stores transact and commonly are valued between. Below are REV, EBITDA, and SDE multiples for a hardware store. Please reach out to discover applicable multiples for your hardware store and to learn how a business valuation can help. Schedule a free consultation today with Peak Business Valuation, business appraiser.

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

A valuation analyst values a hardware store using common valuation approaches, including using valuation multiples for a hardware store. A valuation multiple is like a ratio. The multiple compares two factors to each other. For example, a common multiple in business valuation is the SDE multiple. The SDE multiple compares the seller’s discretionary earnings of the business with the implied value. When using multiples, the expert looks at similar businesses that recently sold on the open market to determine an appropriate multiple for your hardware store. Using several methods, the valuation expert determines a range of value for the hardware store.

For instance, a hardware store generates $380,000 in seller’s discretionary earnings. If the business transacts at a 3.58x SDE multiple, the business has an implied value of $1,360,400. Whereas, if a 3.29x SDE multiple is appropriate, the business is worth approximately $1,250,200.

Peak Business Valuation, business appraiser, works with individuals looking to buy or sell a hardware store. We value hardware stores across the nation. If you are looking to acquire, sell, or expand a hardware store, schedule a free consultation. A business valuation is helpful in each of these scenarios to help you understand the value of a hardware store.

SDE Multiple

Average SDE Multiple range: 3.22x – 3.93x

According to our data, hardware stores sell between a 3.22x – 3.93x SDE multiple. The valuation expert will calculate the implied value of the business using the following calculation. Take the seller’s discretionary earnings and multiply the earnings by the applicable SDE multiple.

SDE X Multiple = Value of the Business

For instance, a hardware store makes $235,000 in seller’s discretionary earnings. It transacts at a 3.89x SDE multiple. In this example, the hardware store’s implied value is $914,150.

$235,000 X 3.89x = $914,150

The seller’s discretionary earnings multiple is a common cash flow multiple. Often hardware stores transact on an SDE multiple. To determine the seller’s discretionary earnings, the expert will take the business’s operating profit and add back any expenses the new owner may not incur. These discretionary expenses can include a fair owner’s compensation (which can increase or decrease the value), any personal expenses the owner runs through the business, and other non-recurring or non-related business expenses.

EBITDA Multiple

Average EBITDA Multiple range: 4.20x – 4.74x

According to our data, the average EBITDA multiple for a hardware store falls within 4.20x – 4.74x EBITDA. To calculate the implied value of the business, multiply the multiple by EBITDA. See the calculation below.

EBITDA X Multiple = Value of the Business

For instance, a hardware store has an EBITDA of $314,000. It transacts on a 4.44x EBITDA multiple. Using the above metrics, the hardware store is worth approximately $1,394,160.

$314,000 X 4.44x = $1,394,160

An EBITDA multiple measures ROI or the company’s return on investment. A valuation expert can prefer this multiple as it normalizes differences in taxation, capital structure, and fixed assets. Normalized ratios allow the valuation expert to compare the subject business to similar businesses. Normalized ratios can more accurately represent the future earnings a buyer can expect from the business.

REV Multiple

Average REV Multiple range: 0.37x – 0.74x

In our data, hardware stores sell for an average of 0.37x – 0.74x of revenue. To calculate the value of the business, take the revenue or sales a business makes and multiply it by the valuation multiple. It is important to use the most recent 12-month period of revenue prior to the determined valuation date. See the calculation below.

Revenue X Multiple = Value of the Business

For example, a hardware store generates $2.7 million in revenue. The valuation expert determines a 0.54x revenue multiple is applicable. In this scenario, the hardware store’s implied value is $1,458,000.

$2,700,000 X 0.54x = $1,458,000

In summary, every transaction of a hardware store is different. When valuing the hardware store, there are many factors that impact the business and the valuation multiple the expert uses. A valuation analyst will determine what multiples for a hardware store are most applicable. Often the valuation expert will use several valuation methods to determine a range of value for the hardware store. For small business transactions, most businesses transact on cash flow multiples. Cash flow multiples – SDE and EBITDA – consider expenses such as COGS, salaries, and rent, among others that impact cash flow.

Summary

When looking at market multiples for a hardware store, keep in mind these numbers are only a guide. The valuation expert will review your company’s financials and key value drivers during the valuation process. Doing so helps determine the applicable multiple to use when determining the fair market value of a hardware store. As such, Peak Business Valuation, business appraiser would love to chat with you more about your hardware store.

Our business appraisers at Peak Business Valuation value hardware stores across the country. We work with individuals looking to buy a hardware store or sell a hardware store. We are happy to answer any questions you have about valuing a hardware store. To get started, schedule your free consultation using the link below.

Schedule Your Free Consultation Today!