Valuation Multiples for Shoe & Footwear Manufacturing

Since the pandemic, the shoe manufacturing industry is experiencing growth. With steady demand for footwear, many manufacturers brought production back in-house with global shutdowns during 2020. However, increasing inflation is causing product prices to increase. These and many more factors impact the value of a shoe and footwear manufacturing business. If you are looking to buy or sell a shoe and footwear manufacturing business obtaining a business valuation is key. A business valuation will detail the value of the business and applicable multiples for shoe and footwear manufacturing.

Peak Business Valuation provides business appraisals for shoe and footwear manufacturers in the United States. Using valuation multiples for shoe and footwear manufacturing is just one method an experienced business appraiser uses to determine the value of a footwear manufacturing business. To learn specific information about your shoe and footwear manufacturing business, schedule a free consultation. Peak Business Valuation, business appraiser, is happy to answer any questions about valuing a shoe and footwear manufacturing business.

Valuing a Shoe & Footwear Manufacturing Business

As a business appraiser is valuing a shoe and footwear manufacturing business there are many aspects they consider. Some of the key value drivers for a shoe and footwear manufacturing business include your product mix, pricing strategy, marketing strategy, and whether your production is local vs overseas, among others. The business appraiser will also use multiples for shoe and footwear manufacturing to determine appropriate market multiples for your business transaction. Using both of these methods, the business appraiser will determine a fair market value for the shoe & footwear manufacturing business.

Peak Business Valuation provides business appraisals for buying a shoe and footwear manufacturing business. A business valuation will help you negotiate a fair purchase price. It is also a useful tool to understand the operations of the company more in-depth so you can feel confident in your business purchase. It will also help you understand where to focus your efforts so you can increase the value of the shoe and manufacturing business.

If you plan on selling a shoe and footwear manufacturing business, a business appraisal will help you decide on a fair listing price. It can also help you maximize the value prior to selling. Many business sellers leave money on the table or don’t sell their business at all due to poor planning or neglect of a good understanding of the value of their business.

Let Peak Business Valuation, business appraiser, help you understand the value of a shoe and footwear manufacturing business. We are happy to answer any questions you have. Schedule a free consultation today to start your business appraisal for a shoe and footwear manufacturing business.

Valuation Multiples for Shoe Manufacturing

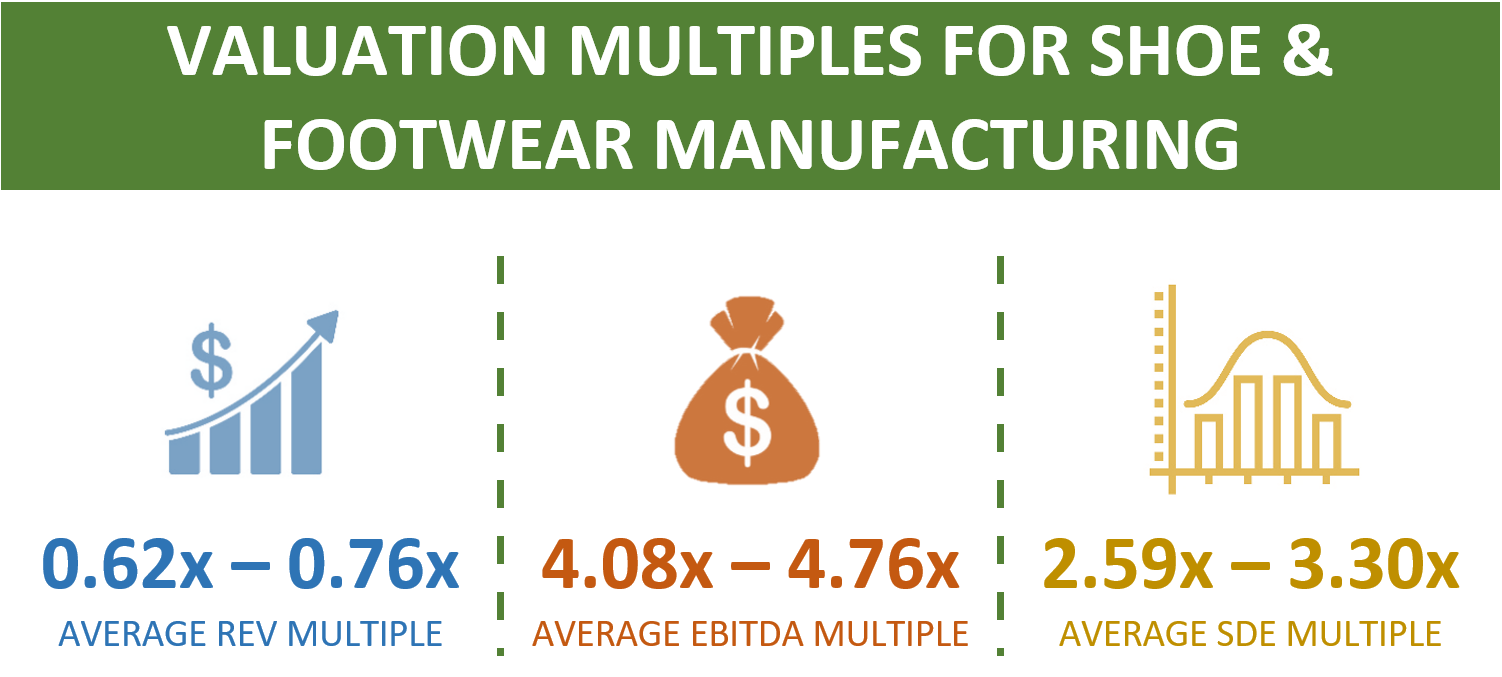

The graphic below shows average valuation multiples for shoe and footwear manufacturing. Keep in mind that these numbers are only a guide. For specific multiples for your shoe and footwear manufacturing business, schedule a consultation with Peak Business Valuation, business appraiser.

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

A business appraiser at Peak Business Valuation will often use multiples for shoe and footwear manufacturing when determining the value of a business. This is just one method to value a shoe and footwear manufacturing business. The valuation process often includes using several business valuation approaches to determine the value of a shoe & footwear manufacturing business.

A valuation multiple is a ratio, it compares two factors. A common multiple in business valuation is the SDE multiple. An SDE multiple compares the seller’s discretionary earnings with the implied value of the business. For example, a footwear manufacturer makes $206,000 in the seller’s discretionary earnings. The business appraiser at Peak determines that a 2.88x SDE multiple is applicable. In this case, the shoe manufacturing business’s value is approximately $593,280. Whereas, if a 3.26x SDE multiple is more appropriate, the footwear manufacturing business is worth approximately $671,560.

Below we discuss how to calculate valuation multiples for shoe & footwear manufacturing businesses. This includes SDE, REV, and EBITDA multiples for shoe & footwear manufacturing. Keep in mind the ranges and numbers below are just a guide. Schedule your free consultation to learn specific information about valuing your shoe and footwear manufacturing business. Peak Business Valuation, business appraiser, is here to help. We appraise shoe & footwear manufacturing businesses in the U.S.

SDE Multiples for a Shoe & Footwear Manufacturer

Average SDE Multiple range: 2.59x – 3.30x

In our data, shoe manufacturing businesses commonly transact between a 2.59x – 3.30x SDE multiple. To calculate the implied value of the shoe & footwear manufacturing business use the following equation. Take the seller’s discretionary earnings and multiply it by the applicable SDE multiple. The calculation follows.

SDE X Multiple = Value of the Business

For instance, the seller’s discretionary earnings of a footwear manufacturer are $190,000. The business appraiser at Peak Business Valuation determines a 3.00x SDE multiple is most applicable. Looking at the above equation, the implied value of the footwear manufacturing business is $570,000.

$190,000 X 3.00x= $570,000

Small businesses such as shoe manufacturers commonly transact on an SDE multiple. The SDE multiple considers expenses such as cash flow. The business appraiser adds back the expenses a new business owner may not incur. Some of these expenses include a fair owner’s compensation, non-recurring or non-related business expenses, and personal expenses, among others. For more information, see Understanding Seller’s Discretionary Earnings.

EBITDA Multiples for Shoe & Footwear Manufacturing

Average EBITDA Multiple range: 4.08x – 4.76x

On average, according to Peak’s data the EBITDA multiples for a shoe manufacturing business range between 4.08x – 4.76x. To calculate the value of the footwear manufacturing business, apply the multiple to EBTIDA. See the equation below.

EBITDA X Multiple = Value of the Business

To illustrate, the EBITDA of a footwear manufacturing business is $143,000. It transacts at a 4.27x EBITDA multiple. In this case, the implied value of the shoe & footwear manufacturing business is approximately $610,610.

$143,000 X 4.27 = $610,610

A business appraiser may find the EBITDA multiple is most applicable to your business transaction because it uses normalized ratios. Normalized ratios make it easier for the business appraiser to compare similar businesses. These ratios normalize differences in capital structure, taxation, and fixed assets. The EBITDA multiple measures the ROI or return on investment an individual can expect to make from the footwear manufacturer. In addition, the EBITDA multiple can more accurately represent the future earnings a buyer can expect to make from the business.

REV Multiples for Shoe & Footwear Manufacturers

Average REV Multiple range: 0.23x – 0.45x

Last, according to our database, REV multiples for shoe and footwear manufacturers commonly range between 0.62x – 0.76x of revenue. To calculate, take the most recent 12-month period of revenue and multiply it by the appropriate REV multiple. Refer to the equation below.

Revenue X Multiple = Value of the Business

For instance, the revenue of a footwear manufacturing business is $867,000. In this scenario, the business appraiser at Peak Business Valuation determines a 0.68x REV multiple is applicable. As such, the shoe & footwear manufacturing business is worth approximately $589,560.

$867,000 X 0.68x = $589,560

When valuing a footwear manufacturing business, the valuation expert will analyze what valuation multiples for shoe and footwear manufacturing are most applicable to your business. In addition, they will use several valuation methods to determine a range of value for your shoe and footwear manufacturing business.

Summary

When you look at valuation multiples for shoe and footwear manufacturing, know that many factors impact them. Each business and business transaction is unique. The business appraiser will analyze your financial statements, operations, and key value drivers, and compare them to similar footwear manufacturing. Using this information and their expertise they will determine the value of the shoe and footwear manufacturing business.

As a business appraiser, Peak Business Valuation values shoe and footwear manufacturing businesses in the United States. We would love to help you understand the value of a footwear manufacturing business and answer any questions about multiples for shoe and footwear manufacturing. Get started by scheduling your free consultation through the link below.

For more information, read Valuing a Shoe & Footwear Manufacturing Business, as well as Value Drivers for a Shoe and Footwear Manufacturer and How to Value a Shoe & Footwear Manufacturing Business.