Valuation Multiples for a Consulting Firm

Companies in the consulting industry provide advisory services to businesses, nonprofits, and public sector agencies. These services may include advisory for human resources, finances, marketing, etc… As such, the consulting industry plays an important role in the economy. According to IBIS World, there are over 900,000 consulting firms in the United States. Over the past several years, the industry generated over $329.9 billion dollars in revenue. We can expect this upward trend to continue as demand remains steady. As such, it may be a good time to buy, grow, or sell a consulting firm. Whether you are entering or exiting the consulting industry, it is crucial to learn about valuation multiples for a consulting firm. When valuing a consulting firm, a business appraiser will commonly use this method.

Valuing a Consulting Firm

Whether you are buying or selling a consulting firm, it is important to learn how to value a consulting firm. It is best to start by receiving a business valuation. When purchasing a consulting firm, a business valuation can help you determine a fair purchase price. The appraiser may also discuss negotiation strategies during a business appraisal. If you are selling a consulting firm, a business valuation can help you understand how to increase its value. A business appraisal for a consulting firm can also help in determining a fair listing price.

When determining the fair market value of a consulting firm, there are two common methods business appraisers may use. One method is the market approach which uses valuation multiples. In this article, we discuss valuation multiples for a consulting firm. Keep in mind, this article is only a guide. For specific guidance, receive a business valuation for a consulting firm. Peak Business Valuation, business appraiser, is happy to assist! We can provide a business valuation and answer any questions you may have on valuing a consulting firm. Start now by scheduling a free consultation with Peak Business Valuation, business appraiser!

Valuation Multiples for Consulting Firms

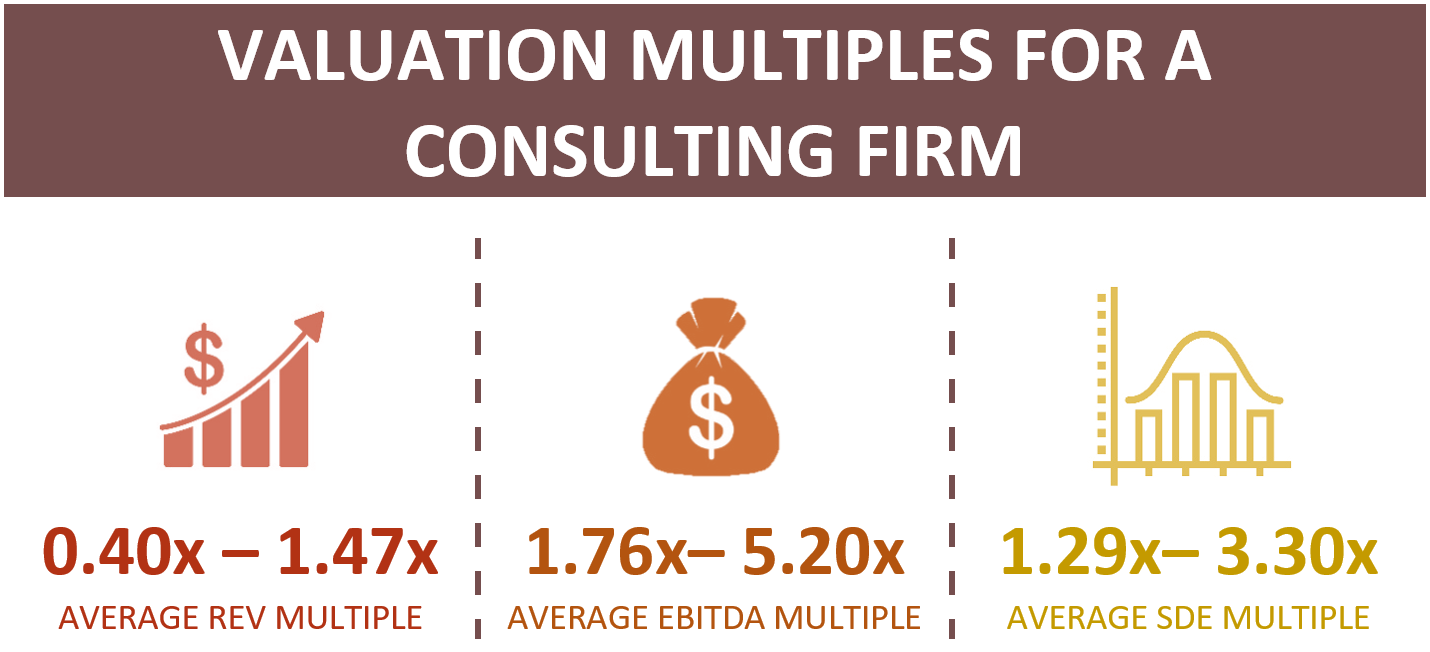

In the diagram below, we share average market multiples for a consulting firm. Typically, there are two valuation approaches that an expert uses to value a consulting firm. Often, business appraisers use the market approach which relies on valuation multiples.

Keep in mind, the values above are only averages. For multiples that are applicable to your consulting firm, obtain a business valuation. Peak Business Valuation, business appraiser, is happy to help! We are happy to provide you with a business valuation for a consulting firm. Peak can also answer any questions you have on valuing a consulting firm. Schedule a free consultation with Peak Business Valuation today!

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

A valuation multiple is similar to a ratio. When using valuation multiples, an expert compares a business’s value to a financial metric. This may include sales, cash flow, or earnings. For instance, a common ratio is the SDE multiple. This multiple compares the seller’s discretionary earnings of the consulting firm to the implied value of the company. The appraiser assesses the multiples of similar firms that have recently sold on the market to determine a fair market value.

For example, suppose that a consulting firm has $600,000 in SDE and receives a 2.63x SDE multiple. In this example, the firm would have an implied value of $1,578,000 ($600,000 times 2.63x). Conversely, a 3.29x multiple indicates that the value of the company is $1,974,000 ($600,000 times 3.29x).

Peak Business Valuation, business appraiser works with many individuals who are buying or selling a consulting firm. The following paragraphs highlight average valuation multiples for a consulting firm. These market multiples are what consulting firms generally transact at. Since each consulting firm is unique, it is important to note that the range of value may vary. Below, we discuss SDE, EBITDA, and REV multiples for consulting firms. For more information, schedule a free consultation with Peak Business Valuation, business appraiser!

SDE Multiples for a Consulting Firm

Average SDE multiple range: 1.29 – 3.30x

According to our data, consulting firms transact at an average SDE multiple of 1.29x – 3.30x. To calculate an implied value of a consulting firm, apply the multiple to the seller’s discretionary earnings. See the following equation.

SDE X Multiple = Value of the Business

Suppose a consulting firm generates $990,000 in seller’s discretionary earnings and transacts at a 2.44x multiple. In this case, the business value is about $2,415,600.

$990,000 X 2.44x = $2,415,600

It is common for business appraisers to use SDE multiples when valuing a consulting firm. To calculate SDE, the valuation expert takes the consulting firm’s profit and adds back any expenses that may not be incurred by the new owner. These expenses can include personal transactions, owner’s compensation, and non-recurring or non-related business expenditures. This helps the expert determine the potential cash flow of the consulting firm. This is crucial when valuing a consulting firm.

EBITDA Multiples for Consulting Firms

Average EBITDA Multiple range: 1.76x – 5.20x

According to Peak’s data, the average EBITDA multiples for a consulting firm range between 1.76x – 5.20x. Apply this multiple to EBITDA to determine an implied value of the business. Refer to the following calculation.

EBITDA X Multiple = Value of the Business

For example, a consulting firm has an EBITDA of $870,000 and transacts at an EBITDA multiple of 3.86x. Using the above metrics, the consulting firm is worth approximately $3,358,200.

$870,000 X 3.86x = $3,358,200

An EBITDA multiple helps estimate a consulting firm’s return on investment (ROI). Valuation experts may prefer using the EBITDA multiple since it helps normalize differences. This allows comparisons to be made between similar consulting firms. Normalized ratios provide an accurate representation of the future earnings that a buyer can expect from a consulting firm.

REV Multiples for a Consulting Firm

Average REV Multiple range: 0.40x – 1.47x

On average, consulting firms sell an average of 0.40x – 1.47x of revenue. A valuation expert can determine the implied value of the business by multiplying the amount of revenue a consulting firm makes by the REV multiple. See the equation below:

Revenue X Multiple = Value of the Business

For instance, a consulting firm makes $3,600,000 in revenue. It then transacts at a 0.84x multiple. In this case, the business is worth approximately $3,024,000.

$3,600,000 X 0.84x = $3,024,000

Generally, REV multiples for consulting firms are less reliable than SDE and EBITDA multiples. When valuing a consulting firm, the appraiser will use their expertise to determine what is best. This may involve using a combination of methods and multiples to determine a range of value for the consulting firm.

Summary

There are many factors to consider when using valuation multiples for a consulting firm. It is best to receive a business valuation for a consulting firm. Peak Business Valuation, business appraiser, is here to help! As part of the valuation process, the expert determines the applicable multiples for your consulting firm. They then help you understand the value of your consulting firm and how to increase it.

Peak works with many consulting firms throughout the country. We are happy to help you prepare to buy, expand, or sell a consulting firm. Peak can provide you with a business valuation and answer any questions you may have on valuing a consulting firm. Start by scheduling a free consultation with Peak Business Valuation!

For more information see Valuing a Consulting Firm, How to Value a Consulting Firm, and Value Drivers for a Consulting Company.