Valuation Multiples for a Financial Advisory

Financial advisory firms are fascinating businesses. One of the “quick and dirty ways” a valuation expert values a financial advisory firm is using multiples. A valuation multiple is like a ratio. A ratio compares two things to each other, for example, one of the more commonly used ratios in valuation is a revenue multiple. A revenue multiple compares the revenue of the company, with the implied value of the company. The calculation for these multiples come from other firms that recently sold on the open market. (The calculation for these other firms is Sale price/Revenue.) A valuation expert can then apply these multiples to your company to give you a range of value.

For example, if a company has $500,000 in Revenue, and transacts at a 0.5x revenue multiple, then the business would be worth $250,000. ($500,000 time 0.5) On the contrary, a 2.0x multiple would imply the value of the company is $1,000,000. ($500,000 times 2)

Peak Business Valuation, business appraiser Texas, works with numerous practices that are looking to sell or expand their book of business. As we work with multiple financial advisory firms, we have come to recognize some of the common multiples financial advisory firms transact and are valued at. We are happy to answer any additional questions you may have. Reach out by scheduling a free consultation.

***Disclaimer: These multiples have been provided for educational purposes only. As such, the information provided does not constitute valuation advice and should not be acted as such. These multiples do not represent the valuation opinion of Peak Business Valuation or any of its valuation professionals. Instead, you should seek the guidance and advice of a qualified business valuation professional with respect to any matter contained in this article.

Most Common Industry Multiples

The two most common multiples to look at include revenue and EBITDA multiples. A multiple of SDE (Seller’s Discretionary Earnings) is not as common as an EBITDA multiple. The reason why an SDE multiple is not as common as an EBITDA multiple goes back to one of the foundations of business valuation. This has to do with the valuation being completed on the premise of a hypothetical sale.

A “hypothetical sale is one that takes place between a hypothetical willing buyer and a hypothetical willing seller.” In this hypothetical situation, the buyer is most likely to be a financial advisor with an already established firm that is looking to increase their book of business with the acquisition of another book of business. As such, the buyer generally already takes a form of compensation from their current book of business. And, therefore, would not take an additional salary from the book of business they are acquiring. As such, EBITDA and SDE are generally the same metric for this exercise. Therefore, revenue and EBITDA are the most common multiples that Peak Business Valuation, business appraiser Texas, recognizes in the industry.

Revenue Multiple

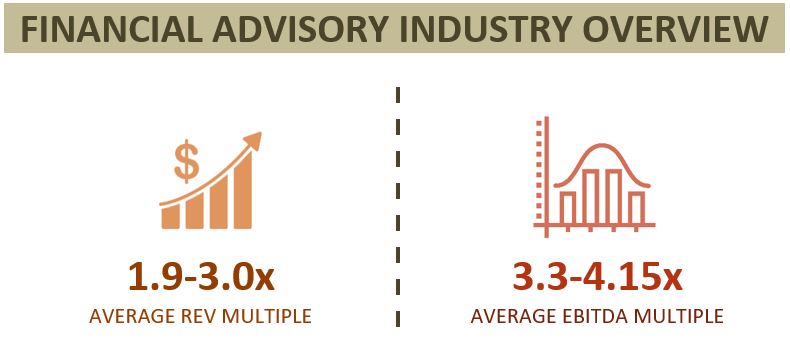

Average Revenue Multiple Range in 2020: 1.9-3.0x

According to our data, in 2020 financial advisory and investment management companies transacted between a 1.9-3.0 average revenue multiple. To derive an implied value of a business, apply the multiple by the most recent 12-month period revenue. The calculation is as follows:

Revenue X Multiple = Value of the Business

For instance, if a financial advisory firm generates $400,000 in revenue and transacts at a 2.54x multiple, then the business value is worth approximately $1,016,000.

$400,000 X 2.54x = $1,016,000

This calculation is straightforward. However, most financial advisory firms do not transact wholly on a revenue multiple. The reason being a revenue multiple does not consider the operations of a business. As such, this multiple is generally not the best indication of value. If a revenue multiple is relied upon, it is usually relied upon in conjunction with a cash flow multiple. It is important to look at cash flow multiples because cash flow multiples consider expenses that impact the cash flow. For instance, rent, operating expenses, and salaries.

EBITDA Multiple

Average EBITDA Multiple Range in 2020: 3.3-4.15x

The average EBITDA multiples for financial advisory companies in 2020 range between 3.3-4.15. Apply this multiple to the EBITDA of a business to derive an implied value of the business. The calculation is as follows:

EBITDA X Multiple = Value of the Business

For example, a financial advisory firm has an EBITDA of $275,000 and transacts at an EBITDA multiple of 3.71x. Using the above metrics, the financial advisory firm is worth approximately $1,020,250.

$275,000 X 3.71x = $1,020,250

The EBITDA multiple measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation, and fixed assets. Normalized ratios allow for comparisons to similar businesses.

Summary

As you can see, in this example both approaches to valuing a financial advisory firm give us similar implied values. However, these multiples are not always the best way to value a company, they are simply rules of thumb. These multiples are also based on what Peak Business Valuation, business appraiser Texas, has seen in the last few months as we have worked with numerous financial advisory firms. There are many more complex details that affect the valuation of a Financial Advisory firm including value drivers for a financial advisory.

Sometimes, when circumstances warrant, a much lower or higher multiple is appropriate. For more information check out our blog on Valuing a Financial Advisory, How to Value a Financial Advisory, and Value Drivers for a Financial Advisory Firm.. Or reach out with questions! Peak Business Valuation, business appraiser Texas, is always happy to help. Schedule your free consultation below!

Schedule Your Free Consultation Today!