Valuation Multiples for a Textile Business

The textile mill industry includes businesses that spin and manufacture various fibers into an array of textile products. Most notably products include yarn, woven and nonwoven fabrics, window curtains and drapes, linens, bags and canvas, and other textile products. Within the United States there are over 13,000 textile businesses. With low concentration but high competition there are many transactions of textile businesses each year. Whether you are looking to buy a textile mill or sell a textile mill, obtaining a business valuation will determine the value of the textile mill business. Part of the process of valuing a textile mill includes using valuation multiples for a textile business.

Valuing a Textile Mill Business

When a valuation expert is valuing a textile mill, there are many important factors they consider. This can include price of materials including commodities like cotton, steel, iron, oil, etc… The business appraiser will also consider the efficiency of the operations of the textile mill, revenue streams, and more. As a business appraiser, Peak Business Valuation will take each of these factors and more into consideration when determine the value of a textile mill. Using various valuation methods, the business appraiser determines a fair market value for your textile mill business.

Understanding the value of a textile mill is important whether you are buying a textile mill or selling a textile business. A business valuation report will determine the fair value and help you understand the strengths and weaknesses of the textile mill.

If you plan on buying a textile business, obtaining a business valuation for a textile mill can help you determine a fair purchase price. The business appraisal is also a very useful tool when you are negotiating the purchase price with the seller of the textile mill.

Knowing the value of your textile mill is an important piece of selling a textile mill. A business valuation can help you understand a fair listing price. You don’t want to list your business too high and risk not selling, and you don’t want to list to low and undersell your business. A business appraisal will help you understand a range of value for what a willing buyer and willing seller are willing to transact at.

Peak Business Valuation, business appraiser, values textile mills across the country. We are happy to help you understand the value of your textile mill business. Get started by scheduling your free consultation today!

Valuation Multiples for a Textile Mill

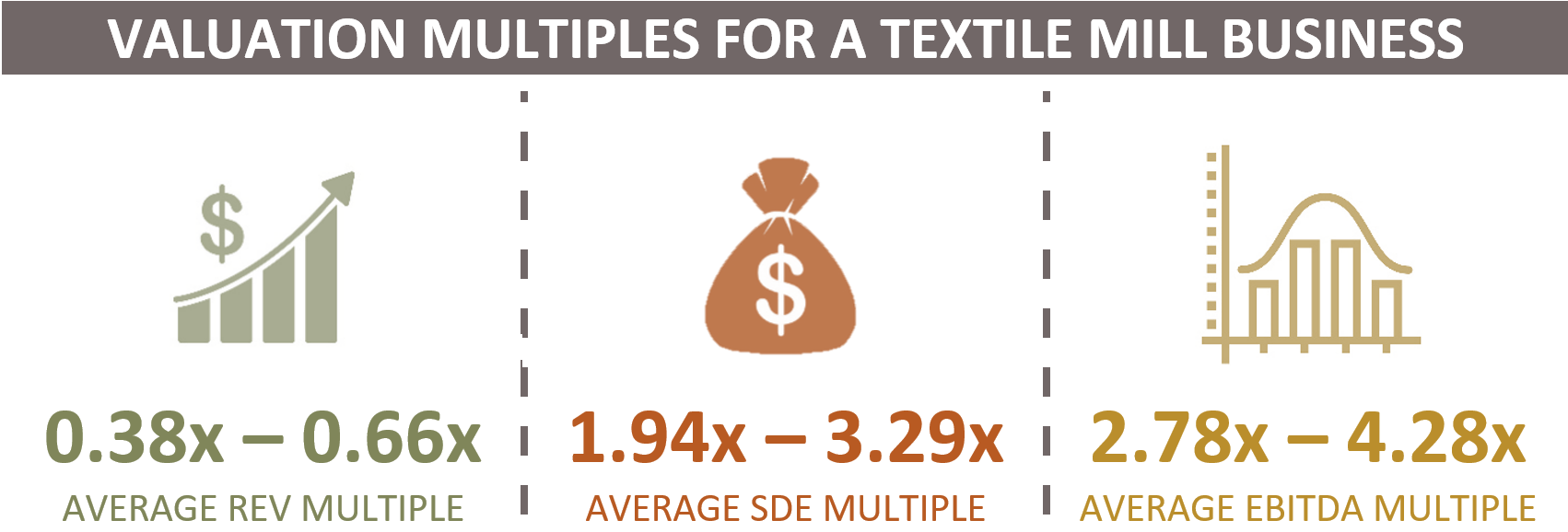

Below are average valuation multiples for a textile mill. The multiples include REV, SDE, and EBITDA multiples for a textile mill. Keep in mind the below numbers are averages and should only be used as a guide. For specific information about a textile mill you are buying or selling, schedule a free consultation with Peak Business Valuation, business appraiser.

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

Valuation multiples for a textile mill are commonly used when determining the value of a textile mill business. A valuation multiple is similar to a ratio. The valuation multiple compares two factors. When using valuation multiples for a textile mill, the business appraiser will compare your textile business to similar textile mills that recently sold. Doing this comparison helps to determine an applicable market multiple for your textile mill. This is just one valuation method a business appraiser uses when determining a range of value for a textile business.

One of the most common valuation multiples in business valuation is an SDE multiple. An SDE multiple compares the seller’s discretionary earnings of the business with the implied value of the business. For instance, the seller’s discretionary earnings of a textile business are $279,000. Using a 2.70x SDE multiple, implies the value of the textile mill business is $753,300. ($279,000 times 2.70x) Whereas, if a 2.13x SDE multiple is applicable, the implied value of the textile mill is $594,270. ($279,000 times 2.13x)

As a business appraiser, Peak Business Valuation provides business valuations for textile mills across the country. We commonly work with individuals who are buying or selling a textile business. Get started with your business valuation by scheduling a free consultation. We are happy to answer any questions about valuing a textile mill.

SDE Multiples for a Textile Business

Average SDE Multiple range: 1.94x – 3.29x

According to Peak’s data, textile businesses on average transact between a 1.94x – 3.29x SDE multiple. To calculate the implied value of the textile mill, take the seller’s discretionary earnings and multiply them by the appropriate SDE multiple. See the calculation below.

SDE X Multiple = Value of the Business

For example, a textile business makes $210,000 in seller’s discretionary earnings. The business appraiser determines a 3.02x SDE multiple is applicable. Using the above calculation, the textile business has an implied value of approximately $634,200.

$210,000 X 3.02x = $634,200

A seller’s discretionary earnings multiple is common for small businesses to transact on. To calculate seller’s discretionary earnings take the company’s operating profit and add back any expenses the new owner potentially may not incur. Common add-backs in business valuation may include any personal expenses ran through the business, non-related or non-recurring business expenses, and a fair owner’s compensation.

EBITDA Multiples for a Textile Business

Average EBITDA Multiple range: 2.78x – 4.28x

In our data, average EBITDA multiples for a textile business range between 2.78x – 4.28x. To derive the implied value of the textile mill, use EBITDA and apply the appropriate multiple. The calculation is below.

EBITDA X Multiple = Value of the Business

For instance, the EBITDA for a textile business is $220,000. It transacts at a 3.54x EBITDA multiple. Using the above calculation, the approximate value of the textile business is $778,800.

$220,000 X 3.54x = $778,800

An EBITDA multiple measures the ROI or return on investment an investor expects to make from the textile business. A valuation expert may determine this multiple is most applicable as it normalizes differences in capital structure, taxation, and fixed assets. Normalized ratios allow the valuation expert to compare similar textile businesses. In addition, using normalized ratios can more accurately reflect the future earnings a buyer can expect from the textile business.

REV Multiples for a Textile Business

Average REV Multiple range: 0.38x – 0.66x

Last, according to Peak Business Valuation’s data, textile businesses sell on average between a 0.38x – 0.66x revenue multiple. A revenue multiple may be less common to rely on, but in some instances may be applicable for your textile business. To determine the implied value, use the most recent 12-months of revenue and multiply it by the applicable REV multiple for the textile mill. The calculation follows.

Revenue X Multiple = Value of the Business

For example, a textile business generates $1.3 million in revenue. Using a 0.55x REV multiple means the textile business has an implied value of approximately $715,000.

$1,300,000 X 0.55x = $715,000

When valuing a textile mill, a business appraiser at Peak Business Valuation will determine what valuation multiples are most applicable for your textile business. Often small businesses transact on cash flow multiples – SDE and EBITDA multiples. This is due to cash flow multiples considering expenses such as COGS, salaries, rent, and other expenses.

Summary

When viewing valuation multiples for a textile mill, understand many factors impact them. A business appraiser at Peak Business Valuation will analyze your company financials and key value drivers when determining appropriate market multiples for your textile business. They will also compare your textile business to similar textile mills that recently sold. Using several business valuation approaches they will determine a fair market value for the textile mill business.

Peak Business Valuation, business appraiser, provides business appraisals for textile businesses across the country. We are happy to help you understand the value of a textile business and appropriate market multiples for a textile business. Schedule your free consultation using the link below.

See also Valuing a Textile Mill. As well as Valuation Multiples for a Textile Business and How to Value a Textile Mill.