Valuation Multiples for an Electrical Company

The electrician industry includes businesses that primarily install and service electrical wiring and equipment. Electrical contractors perform installations, additions, maintenance, alterations, and repairs. The electrician industry has nearly 219,314 businesses. Electrical companies generate over $179 billion in revenue. With a growth rate of 2.6% over the last five years, the industry is expected to continue strong growth over the next five years. As such, now is a great time to buy or sell an electrical company. One of the first steps to buying or selling an electrical company is understanding the value of an electrical company.

Valuing an Electrical Company

Understanding the value of an electrical company can be complex. If you are an electrician looking to grow your business, a business valuation can help you identify where you are currently at. Additionally, it can identify ways to grow your electrical company and maximize the value. If you are preparing to sell an electrical company, a business appraisal can help determine the fair market value. It can also prepare you for negotiations with potential buyers. A business valuation can also help if you are buying an electrical company by determining a fair purchase price. The first step of any of these is to understand the value of an electrical company. You can get started today by scheduling a free consultation with Peak Business Valuation.

Many individuals wonder how to value an electrical company. A valuation expert will use various methods including the income approach, asset approach, and market approach. One of the ways a valuation expert values an electrical company is by using valuation multiples. Below is a brief overview of valuations multiple for an electrical company. Keep in mind these numbers are averages and are only a guide. For specific information about your company, schedule a free consultation. Be sure to also check out our article on Valuing an Electrical Company, How to Value an Electrical Company, and Value Drivers for an Electrical Company.

Valuation Multiples for an Electrical Company

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or any of its valuation professionals. Instead, you should seek the guidance and advice of a qualified business valuation professional concerning any matter contained in this article.

What is a Valuation Multiple?

A valuation expert values an electrical company using a variety of methods. One such method uses valuation multiples. A valuation multiple is a ratio that compares two factors to each other. One of the most common valuation multiples or ratios in business valuation is an SDE multiple. An SDE multiple compares the seller’s discretionary earnings with the implied value of the company. A valuation expert looks at multiples of recently sold similar businesses and applies the multiple to your electrical company to get a range of value.

For instance, an electrical company has $411,900 in SDE. The valuation expert applies a 2.49x SDE multiple to the business. In this case, the implied value of the electrical company is $1,025,631. ($411,900 times 2.49x) In another case, the valuation expert uses a 2.74x multiple. This would imply the value of the company would be $1,128,606. ($411,900 times 2.74x)

Peak Business Valuation works with dozens of individuals looking to buy, sell, or grow an electrical company as a business appraiser. As we have worked with electrical companies, here is a range of valuation multiples electrical companies transact and are valued at. Every electrical company is different and as such there can be a significant range of value. Below we discuss SDE, EBITDA, and REV valuation multiples for an electrical company.

SDE Multiple

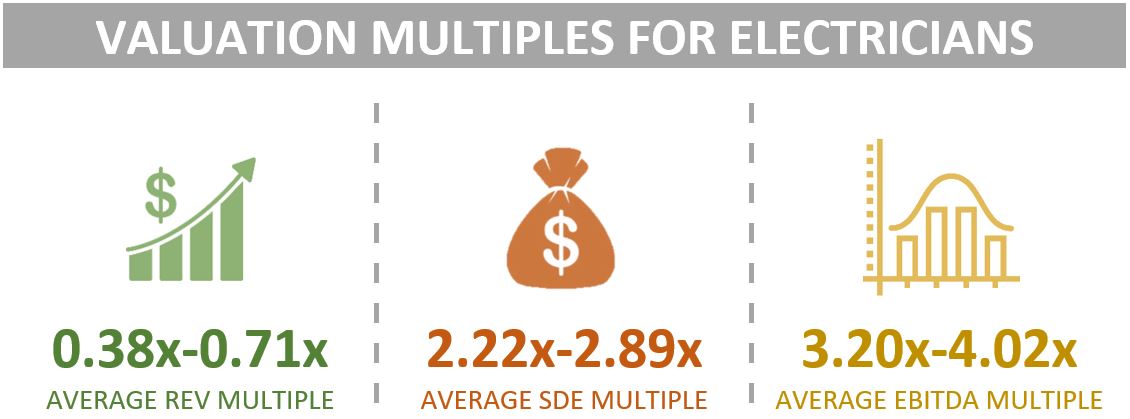

Average SDE Multiple range: 2.22x – 2.89x

According to our data, electrical companies transact on average between a 2.22x – 2.89x average SDE multiple. To derive an implied value of an electrical company, apply the multiple by the most recent 12-month period of revenue. The calculation is as follows:

SDE X Multiple = Value of the Business

For instance, an electrician generates $345,000 in sellers’ discretionary earnings and transacts at a 2.60x multiple. Using the calculation, the business value is approximately $897,000.

$345,000 X 2.60x = $897,000

Seller’s discretionary earnings is a common cash flow multiple. Valuation experts often use it when valuing small businesses specifically electrical contractors. It starts by calculating the company’s operating profit and adding back potential expenses that may not be incurred by a new owner. These expenses may include the owner’s compensation, the owner’s personal expenses, and other expenses such as non-recurring or non-related business items.

EBITDA Multiple

Average EBITDA Multiple range: 3.20x – 4.02x

The average EBITDA multiple for an electrical company ranges between 3.20x – 4.02x. Apply this multiple to EBITDA to derive an implied value of the business. The calculation is as follows:

EBITDA X Multiple = Value of the Business

For example, an electrical company has an EBITDA of $327,000 and transacts at an EBITDA multiple of 3.82x. Using the above metrics, the electrical company is worth approximately $1,249,140.

$327,000 X 3.82x = $1,249,140

An EBITDA multiple measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation, and fixed assets. Normalized ratios allow for comparisons to similar businesses. Normalized ratios also more accurately represent the future earnings a buyer can expect from the business.

REV Multiple

Average REV Multiple range: 0.38x – 0.71x

According to our data, electrical companies sell for an average of 0.38x – 0.71x revenue multiple. You can calculate the implied value of the business by multiplying the amount of revenue or sales an electrical company makes by the valuation multiple.

Revenue X Multiple = Value of the Business

For instance, an electrical contractor makes $2,100,000 in revenue and transacts at a 0.59x multiple. In this case, the business is worth approximately $1,239,000.

$2,100,000 X 0.59x = $1,239,000

A valuation expert most often uses SDE multiples and EBITDA multiples to value an electrical contractor business. This is because cash flow multiples – SDE & EBITDA – consider expenses that impact the cash flow. A revenue multiple is less often used as it does not consider the operations of the business. However, there may be certain instances where this multiple is applicable.

Summary

When using valuation multiples, keep in mind many factors impact the business. Consequently, these factors impact the valuation multiple an expert uses to value the electrical contractor business. Peak Business Valuation, business appraiser, would love to talk with you more about the factors that may impact the value of an electrical company. For more information, see Valuing an Electrical Company.

Peak Business Valuation loves working with small business owners to maximize the value of an electrical company. We focus on providing valuable information to help electricians grow, sell, or buy an electrical company. Peak performs business valuations for electricians regularly. Questions are always welcome! Get started today by scheduling your free consultation!