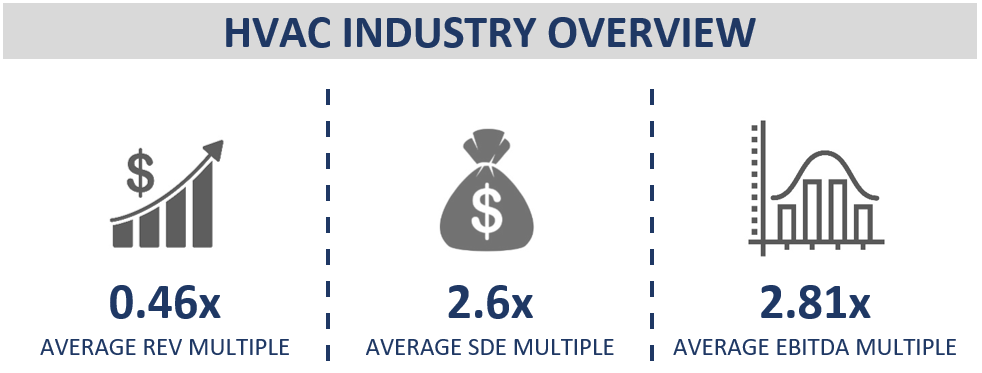

Valuation Multiples for HVAC Companies

The HVAC industry is mainly companies that primarily install and service heating, ventilation, air-conditioning (HVAC), and refrigeration equipment. Here is a quick summary of what HVAC multiples look like. Be sure to also check out our post on Valuing your HVAC Company.

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

Revenue Multiple

According to our data, in 2019 HVAC companies transacted at an average revenue multiple of 0.46x. In order to derive an implied value of a business, apply the multiple by the most recent 12-month period revenue. The calculation is as follows:

Revenue X Multiple = Value of the Business

For instance, if an HVAC company generates $650,000 in revenue and transacts at a 0.46x multiple, then the business value is worth approximately $299,000.

$650,000 X 0.46x = $299,000

This calculation is straightforward. However, most HVAC companies do not transact on a revenue multiple. The reason being, a revenue multiple does not take into consideration the operations of a business. As such, this multiple is not relied upon. Therefore, it is important to look at cash flow multiples. Cash flow multiples consider expenses that impact the cash flow. For instance; rent, COGS, and salaries.

Seller’s Discretionary Earnings (SDE) Multiple

In 2019, the average SDE multiple was 2.6x for HVAC companies. To derive an implied value of the business apply this multiple to SDE. The calculation is as follows:

SDE X Multiple = Value of the Business

For example, if an HVAC company has seller’s discretionary earnings of $350,000 and transacts at a 2.6x multiple, then the business is worth approximately $910,000.

$350,000 X 2.6x = $910,000

Seller’s discretionary is a common cash flow multiple used in small business transactions. Derive SDE by starting with your company’s EBITDA and adding back potential expenses that a new owner would not otherwise incur. These expenses may include owner’s compensation, managers salary, other expenses such as auto, and nonrecurring items, or events such as legal fees, or consulting.

This approach is most frequently used as a valuation method for small businesses with sales less than $3M.

EBITDA Multiple

The average EBITDA multiple for HVAC companies in 2019 was 2.81x. This multiple is applied to EBITDA for a business to derive an implied value of the business. The calculation is as follows:

EBITDA X Multiple = Value of the Business

For example, a HVAC company has an EBITDA of $750,000 and transacts at an EBITDA multiple of 2.81x. Using the above metrics, the HVAC company is worth approximately $2.1M.

$750,000 X 2.81 = $2,107,500

The EBITDA multiple measures a company’s return on investment (ROI). This multiple is preferred as it is normalized for differences in capital structure, taxation and fixed assets. Normalized ratios allow for comparisons to similar businesses.

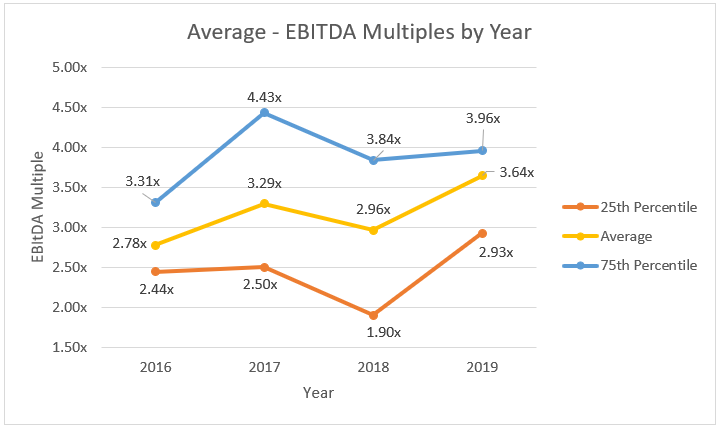

Average EBITDA Multiples

The following graphic shows how EBITDA multiples have trended over the last 4 years in the HVAC industry.

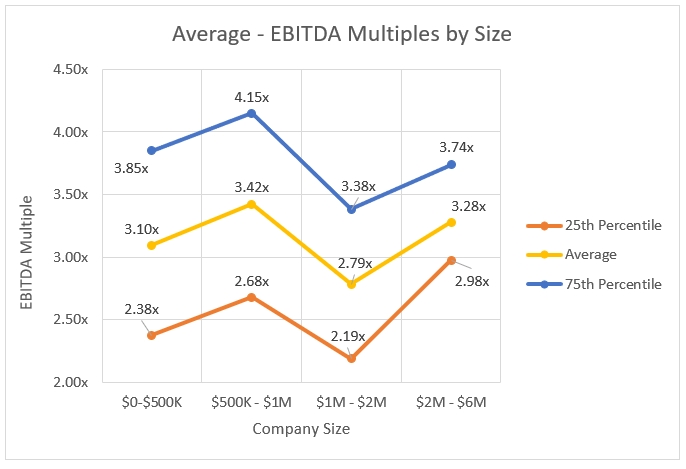

Impact of Size on the Valuation Multiple

The following graphic shows how business size impacted EBITDA multiples in the HVAC industry over the last 4 years.

Peak Business Valuation enjoys working with small business owners to help maximize their HVAC company’s value. We focus on providing valuable information to help you grow, sell, or buy an HVAC company. We work with many HVAC business owners to provide HVAC company valuations. Questions are always welcome. Please reach out by scheduling a free consultation.

See also How to Value an HVAC Company, Value Drivers for an HVAC Company, and Valuing HVAC Companies.

Schedule Your Free Consultation Today!