Value of Equipment: Liquidation, Replacement, or Fair Market?

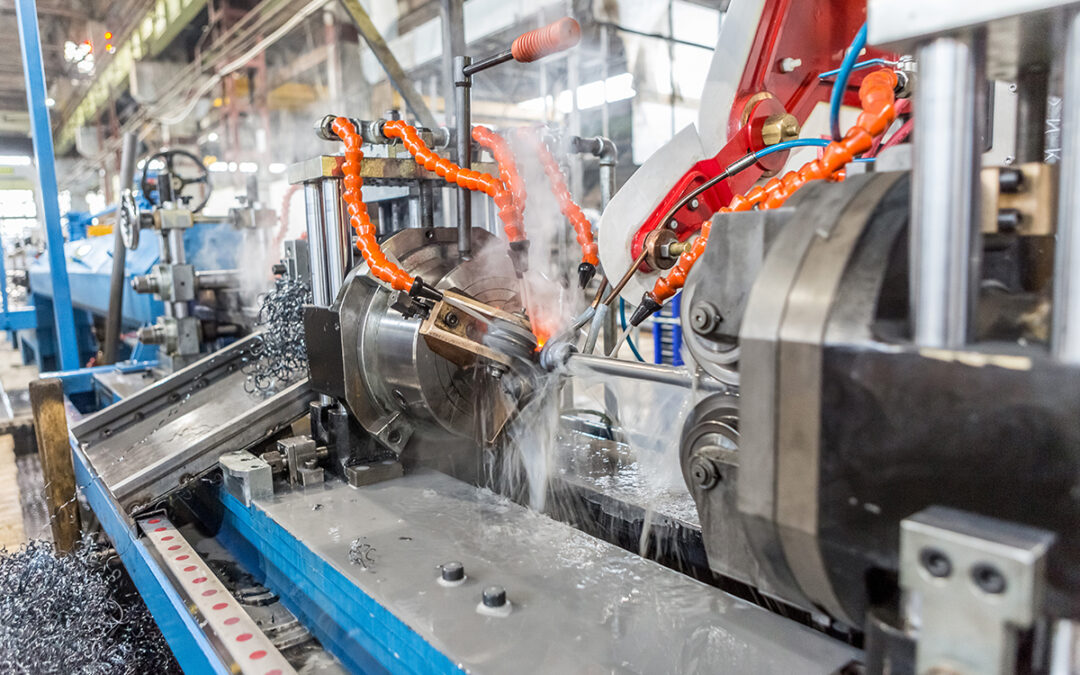

In the world of business, determining the value of equipment is paramount. You may be responsible for financial reporting, asset acquisition, or strategic planning. Understanding the worth of machinery and equipment can significantly impact decision-making processes. Central to this calculation are three key equipment valuation approaches. These include the liquidation value, replacement value, and fair market value. In this article, we explore the nuances of methods for valuing equipment. Understanding this process is key for stakeholders, lenders, buyers, and sellers.

Peak Business Valuation aims to bring collaboration and transparency to equipment valuations. We oppose the values of the dog-eat-dog corporate valuation world. The team we hire and the clients we work with reflect our unique approach. Our consultation is the first step to the fulfillment of this vision. In this meeting, we address your questions and equipment appraisal needs. We look forward to hearing from you!

Understanding the Value of Equipment

The value of machinery and equipment is more than just a monetary figure. It is more than just the original purchase price of equipment. Equipment value represents various factors such as functionality, market demand, and condition. This value can fluctuate with economic, technological, and industry trends. Because of this variability, an equipment appraiser must determine the most appropriate approach. This requires selecting the desired equipment value and method(s) for calculating it.

There are generally three methods for valuing machinery and equipment. Peak Business Valuation uses liquidation, replacement, and fair market value. Each level of value provides a way for classifying the value of business assets. This classification is especially helpful for accountants, analysts, and business owners.

Each equipment valuation approach—liquidation, replacement, and fair market—has its strengths and limitations. Liquidation value offers a conservative estimate focused on short-term cash realization. Replacement value emphasizes long-term asset management and investment planning. Fair market value strikes a balance between these extremes. It provides a holistic view of an asset’s worth under normal market conditions. Understanding each method for valuing equipment is crucial for making informed decisions in equipment valuation.

Liquidation Value of Equipment

First, let’s consider the liquidation value of equipment. This refers to the cash a company could expect to receive from the sale of its machinery and equipment. This is a hypothetical calculation in the case of a forced sale scenario. When do equipment appraisers use this value of equipment? These scenarios typically happen when a company is under distress or urgent conditions. For example, in instances of bankruptcy or insolvency. Understanding liquidation value becomes imperative, as it determines the potential recovery for creditors. Business owners cannot always sell machinery and equipment for their original purchase price. They may not even be able to sell the equipment for what is still due on the financing note. Liquidation value calculates the net cash that could be available in a short timeframe.

How do equipment appraisers calculate the liquidation value of equipment? Equipment appraisers use various valuation methods. For more information on equipment valuation methods, see Machinery and Equipment Valuation Methods. Liquidation value provides an estimate of equipment value. However, it may not reflect its value under normal operating conditions. At the very least, it is a benchmark for financial planning in times of distress.

Replacement Value of Equipment

Second, the replacement value of equipment is the cost to replace an asset with a similar one. This value is a direct comparison with equipment at current market prices. Equipment appraisers, in their research, ask “How much would it cost to buy a substitute?” They first consider the equipment’s function and condition. Then equipment appraisers find equipment for sale with similar characteristics. These characteristics might include the equipment’s model, condition, age, and type.

When does the replacement value of equipment come in handy? Organizations often seek this value when looking to better manage their equipment. The replacement value is the cost of completely replacing the equipment in mind. With this estimate, businesses can decide whether to repair or replace the equipment. In some situations, factoring in depreciation, it may be better to replace. By understanding these costs, owners can be more strategic in their asset management.

Another application of replacement value is for insurance purposes. When determining insurance coverage, this value serves as a benchmark. Businesses need to know what to value machinery and equipment in the event of loss or damage. As such, insurance companies can adequately cover the cost of replacing the equipment. With the replacement value of equipment, businesses can have more clarity in decision-making. It is one of three methods for valuing equipment.

Fair Market Value of Machinery and Equipment

Third, consider the use of fair market value in equipment valuation. This value serves as a pivotal metric for understanding asset worth in an open market. Fair market value is the price at which machinery and equipment would reasonably change hands. There are several qualifications for this transaction. Both the buyer and seller must have reasonable knowledge of the equipment facts. They must also not be under any compulsion to engage in the transaction. If a transaction meets these criteria, then the fair market value is applicable.

While the liquidation is more conservative, the fair market value has more flexibility. This is because it reflects the price under normal market conditions. Since it does not emphasize quick asset disposal, it can take into account many other factors. These include the market demand, asset condition, industry trends, and economic outlook.

When is the fair market value of equipment useful? This value is significant for businesses planning mergers and acquisitions or seeking financing. It can help clarify the understanding of equipment when undergoing financial reporting processes. In essence, this value provides a holistic view of equipment value under prevailing market conditions. As such, businesses can implement better strategic decision-making. During an equipment appraisal, the appraiser will determine which method to value equipment.

Conclusion

In short, the value of equipment depends on many factors. As such, it is important to find a qualified equipment appraiser. Certified machinery and equipment appraisers conduct official equipment appraisals. This process takes careful research and much experience. Because of equipment variability, equipment appraisers use several equipment values and methods. Equipment appraisers consider liquidation, replacement, and fair market values. These values offer valuable insights for strategic decision-making. This understanding is important in the context of risk management and investment analysis.

Peak Business Valuation is a certified machinery and equipment appraiser. Our team has extensive experience valuing machinery and equipment across the nation. As such, our equipment appraisals are efficient, accurate, and comprehensive. To better understand our equipment valuation process, schedule a consultation. We are happy to answer questions about equipment values and methods for valuing equipment. Click the link below to meet today!