Valuation Multiples for an Insurance Agency

The insurance agency and brokerage industry comprises companies that sell insurance policies and annuities. In recent years, this industry has experienced healthy growth, generating over $210 billion dollars in revenue. In addition, demand for insurance agencies remains steady. As the economy improves and premiums increase, the insurance agency and brokerage industry will continue to grow. However, there are over 400,000 insurance agencies in the United States. As such, this industry is extremely competitive. If you are looking to buy, grow, or sell an insurance agency, it is crucial to understand valuation multiples for an insurance agency.

Valuing an Insurance Agency

When valuing an insurance agency, there are many factors to consider. As such, it is beneficial to receive a business appraisal. During a business appraisal, the valuation expert analyzes the key value drivers for an insurance agency. In addition, they will consider the insurance agency’s financial statements. The expert then compares these metrics to similar insurance agencies that recently sold. Using various valuation methods, the business appraiser identifies a fair market value for the insurance agency.

If you are selling an insurance agency, obtaining a business appraisal can help determine a fair listing price. A business appraisal for an insurance agency can also help you maximize the value before selling. Whereas, if you are buying an insurance agency a business valuation is key to negotiating a fair purchase price.

As a business appraiser, Peak Business Valuation loves working with individuals buying or selling an insurance agency. We are happy to answer questions on valuing an insurance agency. Schedule a consultation today. See also Valuing an Insurance Agency, How to Value an Insurance Agency, and Value Drivers of an Insurance Agency.

Valuation Multiples for an Insurance Agency

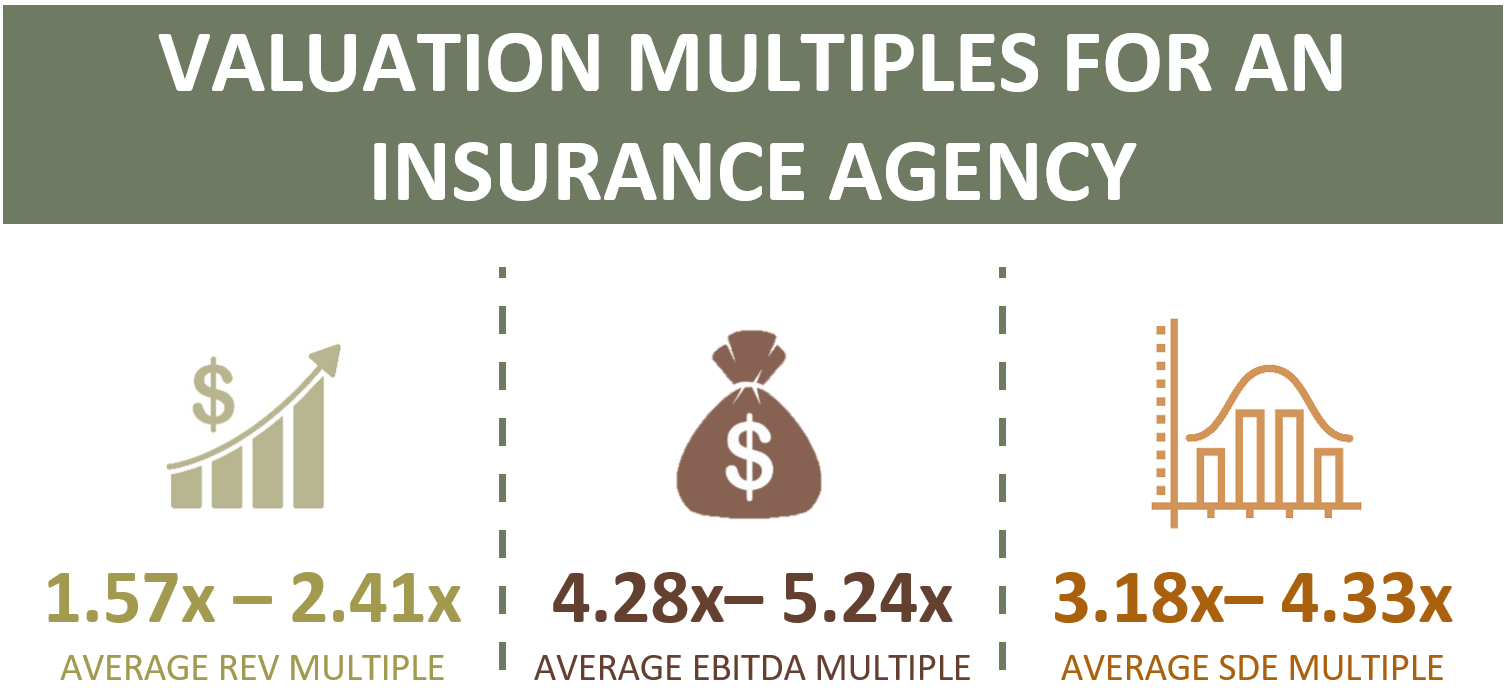

The following image shows average market multiples for an insurance agency. When valuing an insurance agency, a business appraiser at Peak Business Valuation often uses the market approach. This approach relies on valuation multiples. However, this is only a guide. To know the multiples for your insurance agency, receive a business appraisal. Peak Business Valuation is happy to provide your insurance agency with a business appraisal. Schedule a consultation with Peak Business Valuation to learn more!

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

Valuation multiples are ratios that compare an insurance agency’s value to a financial metric. This may include cash flow, earnings, or sales. For example, a popular ratio is the SDE multiple. This multiple compares the seller’s discretionary earnings of the insurance agency to the implied value of the company. To determine a fair market value, a valuation expert analyzes the multiples of comparable insurance agencies that have recently sold on the open market. Then, the expert determines applicable multiples for your insurance agency and provides a range of fair market value.

For instance, suppose that an insurance agency has $215,000 in SDE and receives a 3.75x SDE multiple. In this case, the agency would have an implied value of $806,250 ($215,000 times 3.75x). Conversely, a 3.91x multiple indicates that the value of the company is $840,650. ($215,000 times 3.91x).

Peak Business Valuation, business appraiser, frequently works with individuals looking to buy, grow, or sell an insurance agency. In the following paragraphs, we discuss valuation multiples for an insurance agency. These numbers indicate the range of values that insurance agencies often transact at. It is important to remember that the value range may vary since each insurance agency is unique. Below, we highlight SDE, EBITDA, and REV multiples for an insurance agency. For more information about valuation multiples for an insurance agency, schedule a free consultation with Peak Business Valuation!

SDE Multiples for an Insurance Agency

Average SDE multiple range: 3.18x – 4.33x

According to Peak’s data, insurance agencies transact at an average SDE multiple of 3.29x – 4.12x. To calculate an implied value of an insurance agency, apply the multiple by the most recent 12-month period of revenue. The calculation is as follows:

SDE X Multiple = Value of the Business

Suppose an insurance agency generates $320,000 in seller’s discretionary earnings and transacts at a 3.79x multiple. In this case, the business value is about $1,212,800.

$320,000 X 3.79x = $379,000

SDE multiples are commonly used by business appraisers when valuing an insurance agency. To calculate SDE, the business appraiser takes the insurance agency’s profit and adds back any expenses that may not be incurred by the new owner. These can include personal transactions, owner’s compensation, and non-recurring or non-related business expenditures. Doing this, helps the expert to determine the potential cash flow of the insurance agency. This is vital when determining the value of an insurance agency.

EBITDA Multiples for an Insurance Agency

Average EBITDA Multiple range: 4.28x – 5.24x

On average, insurance agencies transact between an EBITDA multiple range of 4.38x – 4.89x. Apply this multiple to EBITDA to determine an implied value of the business. See the equation below:

EBITDA X Multiple = Value of the Business

For example, an insurance agency has an EBITDA of $268,000 and transacts at an EBITDA multiple of 4.82x. Using the above metrics, the insurance agency is worth approximately $805,000.

$175,000 X 4.60x = $805,000

An EBITDA multiple helps determine a company’s return on investment (ROI). Business appraisers may prefer using the EBITDA multiple because it helps normalize differences. This allows comparisons to be made between similar insurance agencies. Normalized ratios provide an accurate representation of the future earnings that a buyer can expect from an insurance agency.

REV Multiples for an Insurance Agency

Average REV Multiple range: 1.57x – 2.41x

According to Peak Business Valuation’s data, insurance agencies sell an average of 1.82x – 2.33x of revenue. A valuation expert can determine the implied value of the business by multiplying the amount of revenue an insurance agency makes by the REV multiple. Refer to the equation below:

Revenue X Multiple = Value of the Business

For instance, an insurance agency makes $600,000 in revenue. It then transacts at a 1.96x multiple. In this case, the business is worth approximately $1,176,000.

$600,000 X 1.96x = $1,176,000

A professional business appraiser at Peak Business Valuation will determine what multiples for an insurance agency are applicable to your business. Often, a REV multiple is less relied upon. In addition, the appraiser uses various methods to determine a range of values for the insurance agency.

Summary

When using valuation multiples for an insurance agency, there are many factors that a valuation expert considers. The valuation process can be complex. As such, it is best to obtain a business appraisal. Peak Business Valuation, business appraiser Utah, is happy to help! During a business appraisal, we discuss what impacts the value of an insurance agency and the applicable multiples. Additionally, a business appraisal can help you understand the value of an insurance agency and how to increase it.

Peak Business Valuation, business appraiser, values many insurance agencies throughout the country. At Peak, we focus on offering valuable guidance to help you buy, expand, or sell an insurance agency. Peak is happy to provide a business appraisal and answer any questions you may have on valuing an insurance agency. Start now by scheduling a free consultation with Peak below!

Schedule Your Free Consultation Today!